All-Terrain

Investment portfolio strategies

for you and your clients

Designed to smooth the investment road regardless of the market enviroment

Every market has down periods to traverse

An all-terrain vehicle seeks to take you to your goal no matter how rough the landscapes. An all-terrain investment portfolio is designed to provide protection in volatile markets no matter the asset class and regardless of how volatile the market environment.

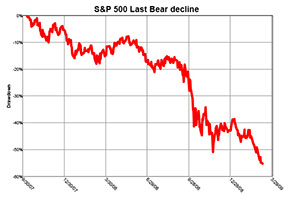

2007 S&P 500 CRASHES

2011 GOLD SLUMPS

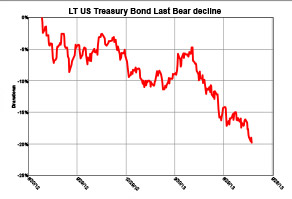

2012 BONDS TUMBLE

What we can do for you

How we can help your clients

![]() Minimize bear market losses

Minimize bear market losses

![]() Navigate sideways markets

Navigate sideways markets

![]() Maximize bull markets

Maximize bull markets

![]() Market cycle math

Market cycle math

![]() Guard against the unexpected

Guard against the unexpected

We employ a wide selection of asset classes through actively managed strategies designed to be nimble in various market environments. Some strategies aim to produce income, others seek growth. All adjust to evolving market conditions.

Want to know more?

Receive a no obligation consultation.

6-time recognized

Inc. 5000

Fastest-growing

Private Company

Q.

A.

How can you help me manage my clients expectations?

Flexible Plan Investments helps you to manage your clients' goals and investment expectations with our OnTarget Investing reporting. You can help your clients set their personal investment benchmark and assess their risk tolerance, while managing and reporting back on their investment progress.

Q.

A.

Why should I use actively managed strategies?

Actively managed strategies are designed to automatically respond to changing market conditions to help preserve capital growth, avoid the temptation to buy high/sell low, and smooth out the volatility of the market while still providing performance.

Q.

A.

How will the All-Terrain strategies help my clients?

Just like all-terrain vehicles take you through a rough landscape, our All-Terrain strategies are designed to provide a smooth ride in volatile markets.

TOP 3 QUESTIONS ASKED BY ADVISORS

Which portfolio would you rather have?

MARKET LOSS MATHEMATICS

Let’s take a look at two different portfolio management styles.

Events during the first year drove the market down, and each portfolio lost money.

However, during the second year, the market recovered

and both portfolios witnessed significant gains.

The proof is in the math.

Avoid drawdowns in the market with active management.

4 - 4

<

>

Multiple All-Terrain strategies

to choose from, all based on your

clients goals and risk tolerance

All-Weather

Static

All-Weather Dynamic

Trivantage

Smarter Beta

flexibleplan.com | 800-347-3539

6-time recognized

Inc. 5000

Fastest-growing

Private Company

PAST PERFORMANCE DOES NOT GUARANTEE FUTURE RESULTS. Inherent in any investment is the potential for loss as well as profit. A list of all recommendations made within the immediately preceding twelve months is available upon written request. Please read Flexible Plan Investments’ Brochure Form ADV Part 2A carefully before investing.